Better Business through SEC’s Clarified Directives on Climate Disclosure Rules

Authors: Amber Bieg & Jennifer Hudler

Does Climate Risk Really Deserve SEC Disclosure?

By Amber Bieg and Jennifer Hudler

In 2017 and 2018, California experienced catastrophic fires fueled by climate change with billions in damages and thousands of lives lost. California’s largest utility, PG&E Corp., filed for bankruptcy in 2018, citing potential liabilities from the California Wildfires as a core reason. Moreover, on January 19, 2018, Moody's downgraded the rating outlooks to "negative" from "stable" for 24 regulated utilities in the US, citing that they estimate that the debt-to-capitalization ratios will continue to increase for regulated electric utilities—catastrophic events playing a huge role in these ratios. But what does this mean for investors trying to evaluate risk?

Maybe try Las Vegas instead. “PCG shares would not be worth buying for any reason other than a casino-like gamble” says Bruce Kaser, head of equity research, the Turnaround Letter in his Forbes article. But investing in the stock market isn’t supposed to be this risky - investors have a right to know what they are investing in and what about insurance?

Due to increased hurricane losses, insurance companies like American International Group (AIG) are reducing property insurance coverage for homes in flood-prone areas along the east coast and fire-prone areas in the western United States. Several insurance companies in Florida have gone bankrupt, and others, like Farmers and AAA, are limiting coverage. In Louisiana, insurance companies are declining to write policies in hurricane-prone areas, according to a report by the Council on Foreign Relations. Most of the US has experienced double digit rate increase with some states seeing up to 30% increase in property insurance premiums.

Enter stage right: the Security and Exchange Commission (SEC). After all, it is the SECs job to protect our investments for the sake of overall economic well-being.

Why Does the SEC Care about Climate Risk?

“Climate risk is economic risk” is essentially the new stand taken by the SEC. The Commission recently took a significant step forward by enhancing transparency and addressing the growing concerns around climate-related risks. On March 6, 2024, the SEC adopted final rules for “The Enhancement and Standardization of Climate-Related Disclosures for Investors.” This ruling amends the Securities Act of 1933 and the Securities Exchange Act of 1934, both enacted after the Great Depression to restore faith in U.S. financial markets by fostering transparency, accountability, and fairness.

These new SEC climate disclosure rulings emphasize investor protection - mandating companies to disclose material climate-related risks (those with an impact greater than 5% of market cap) and opportunities, creating greater trust and confidence in the financial markets with the goal of protecting our economy from catastrophic losses.

Under the ruling, SEC registrants provide specific climate-related information in their registration statements and annual reports. Prior to the SEC ruling, companies who disclosed climate-related information did so at their own discretion and it was not necessarily comparable to peers within the same industry. This lacking comparability and level of assurance hindered efficient and effective risk assessment by investors and business owners. The standard means of reporting created by the SEC ruling aims to bolster investor comparability across publicly-traded companies, ensure a comprehensive understanding of the risks these companies face in the foreseeable future, and gauge their preparedness and mitigation measures.

This is a pivotal step in building a more sustainable and resilient economy for the future. Further details about what was amended and its impact on companies will be discussed in our upcoming webinar this week, Wednesday, April 3rd.

Who is Required to Report and When?

This new rule applies to large companies, most of which already comply with the new rules. Before drafting these rules, the SEC found that 20 percent of public companies disclose information about their Scope 1 and 2 greenhouse gas (GHG) emissions, often outside of SEC filings. Larger entities exhibit higher rates of emissions reporting. Notably, among companies in the Russell 1000 Index, nearly 90 percent publicly disclose some climate-related information, with around 60 percent providing details on their GHG emissions. The urgency stems from the escalating frequency of climate-related disasters, Estimated at prompting numerous companies to incur costs and losses exceeding the SEC's materiality threshold, equivalent to 5% of market capitalization.

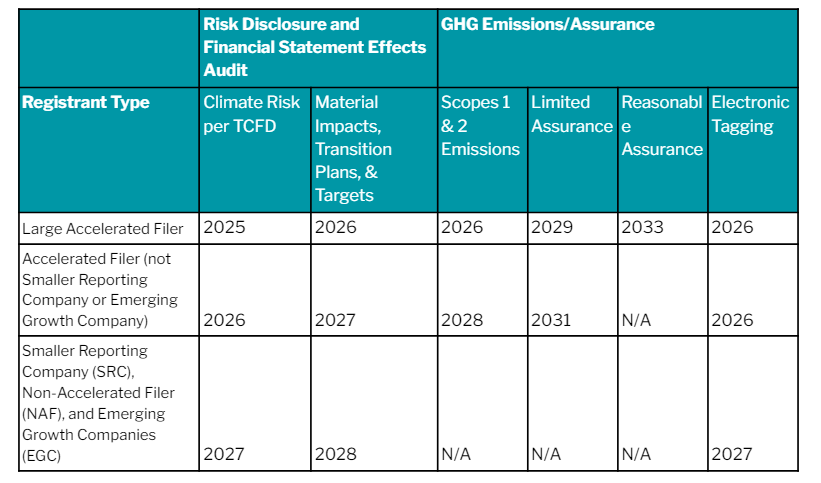

The table below outlines which companies must adhere to the SEC climate-related reporting and when these companies need to report. Please note, the year stated in the table below refers to the fiscal year beginning.

SEC Only Requires Reporting of Material Impacts

What are “material impacts?” The SEC guidance on defining financial materiality is 5% of earnings. But what about material climate risks?

The SEC defines material climate risks as those likely, or reasonably likely, to have a material effect on a company’s financial condition, business strategy, or operating performance. Climate-related risks and opportunities, as well as other information pertinent to these, that present during a reporting period, or are reasonably likely to present, must be disclosed.

How Does this Impact Idaho’s Companies?

What would happen to Lamb Weston’s stock value if potato crops failed due to prolonged drought? How would Idaho Power weather multiple years of lack of snowpack (a significant portion of the company’s power generation comes from hydroelectric power stored as snowpack)? How much more energy would Micron need to cool sensitive equipment during a 100 day heat wave with temperatures in excess of 100 degrees fahrenheit?

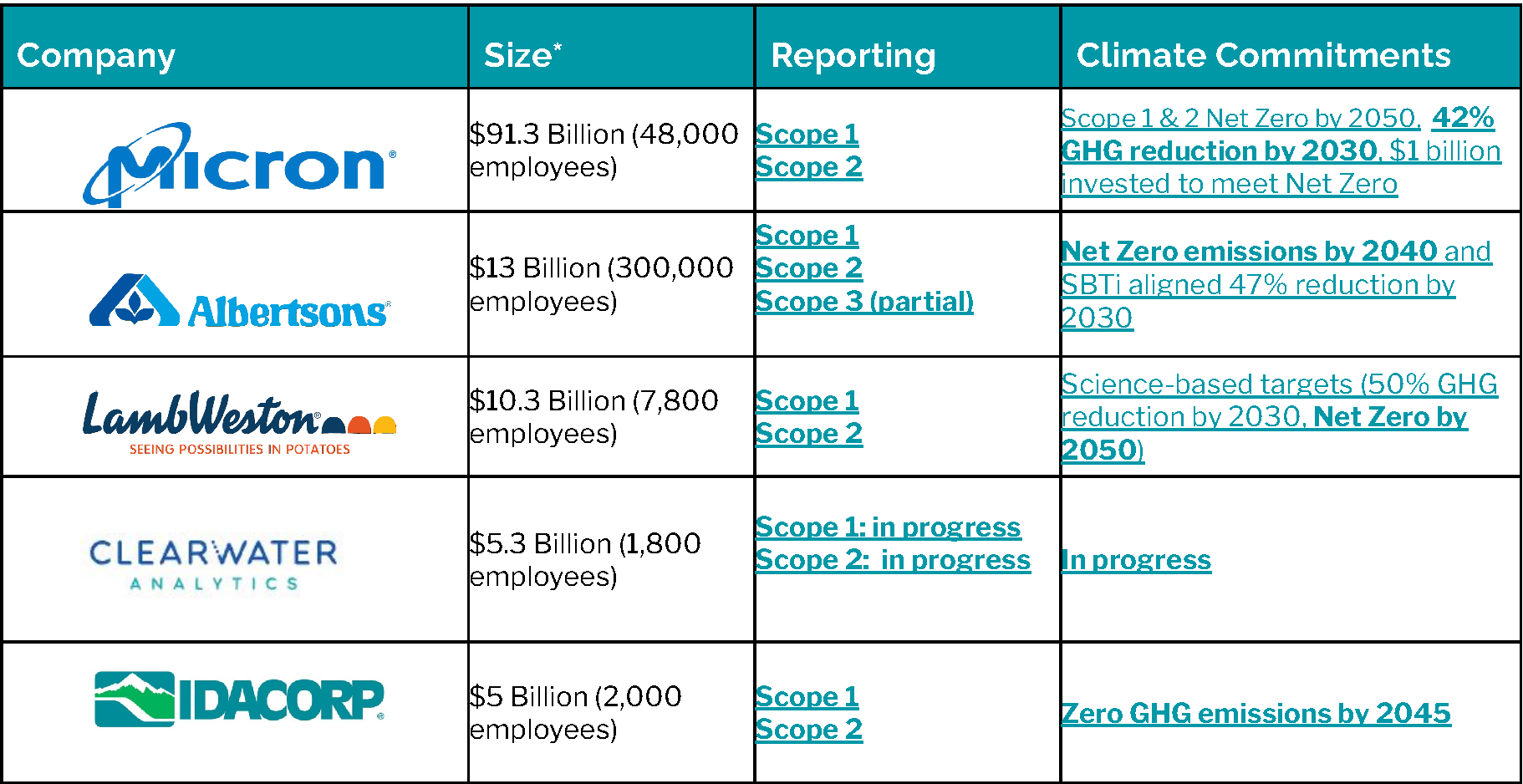

It turns out that most of the large publicly traded companies in Idaho already are thinking about these scenarios and planning for them. Additionally, they also disclose their emissions and climate impacts. Most of Idaho’s publicly traded companies that are subject to the new disclosure rules are already prepared.

As shown in the tables below, Idaho’s largest companies (by *Market Capitalization) already disclose Scope 1 & 2 GHG emissions and have Climate Commitments.

What’s Required for Disclosure?

The disclosure requirements encompass a breadth of climate-related information, including risk identification, management, and mitigation strategies. The disclosures themselves are aligned with the Task Force on Climate-related Financial Disclosures (TCFD) framework. Disclosures must outline climate-related goals, targets, and associated expenditures, alongside capital costs and losses attributable to severe weather events. The rules emphasize integrating climate-related risks into overall risk management systems, with oversight by the board of directors. Materiality definitions are crucial. Risk or opportunities are only deemed material or worth disclosing if they could significantly impact a company's business, finances, or future.

Capital Cost Disclosure - In addition, under the final rules, certain disclosures related to severe weather events and other natural conditions will be required in a registrant’s audited financial statements.

Disclosing Doesn’t have to be Difficult

Here at Warm Springs Consulting, we support high-impact industries on emissions accounting and climate-related disclosures. We’ve worked with private and publicly traded mining and manufacturing companies such as Integra, Vizsla Silver, and EnerSys, as well as smaller companies such as Perpetua. Our expertise lies in navigating the complexities of climate reporting and enabling companies to not only mitigate risks, but also capitalize on emerging opportunities in the ever-evolving landscape of sustainability.

An example witnessed by WSC was the EnerSys TCFD report. It provided a quantification and monetization of climate-related risks, as well as opportunities, that was enlightening to those stakeholders as it became apparent that the opportunities outweighed the risks.

As companies adapt, new costs will be incurred to collect data, report on, and if needed, mitigate climate-related risks. GHG accounting and disclosure reporting costs can range from $10k to $50k, with climate risk report costs also falling within this range, depending on industry and complexity. The materiality of these costs will vary by company; however, for most companies it's an immaterial cost to incur, and could quite possibly save them much more material costs in the future.

Why Should Capitalists Care About Climate Risk?

From a macroeconomic perspective, these rules underscore the importance of transparency to investors, enhancing reliability and comparability of climate-related information. At the micro level, by analyzing climate risk, companies benefit from improved risk management, including reducing supply chain risks and potential disruptions. Transparent climate disclosures foster employee loyalty, stakeholder engagement, facilitate regulatory compliance, and enable companies to identify and capitalize on emerging opportunities in the transition to a low-carbon economy. All of which strengthen investor confidence and enhance competitive advantage. Climate disclosures are intended to act as a mechanism to enhance strategic business and community resilience, while supporting sustainable growth.

A benefit to reporting on climate-related risks is improved shareholder value. Companies that report on and focus on sustainability achieve reduced costs, improved worker productivity, mitigated risk potential, and created revenue-generating opportunities. Further, private equity investors recognize investing in sustainability, inclusive of climate-related disclosures, aids in improved returns and risk mitigation. A 2015 meta-study of more than 2,000 pieces of independent research revealed that 63% of the studies exhibited positive correlation between investing in companies who reported and focused on sustainability information compared to 8% of the studies showing a negative effect.

Ultimately transparent disclosure of risk makes markets competitive and fair. It may seem hard and overwhelming at first, but it’s really not that complicated. It’s smart for business and important for investors.